Microcat EPC – Infomedia’s Biggest Investment to Date

The global automotive industry is currently facing unprecedented market uncertainty and ground-shifting change. OEMs and dealerships from all over the world have been blindsided by the huge impact of the COVID-19 outbreak.

Like many downturns previously, the parts and service business of the dealership is becoming a key focus for maintaining bottom line growth. And for some dealerships, their survival.

Our global OEM partners constantly ask us: “How do I sell more genuine parts?” and “How do I optimise my internal and wholesale parts sales processes?”

These questions are now more salient than ever before.

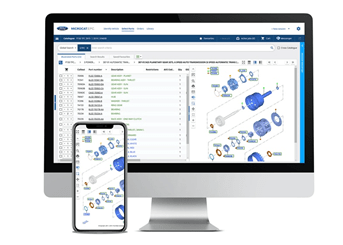

Against this backdrop, I’m excited to announce the new, next-generation release of Microcat EPC that tackles this sales challenge head on. It’s our largest ever investment in the Microcat technology, designed to optimise and grow parts counter effectiveness, today and into the future.

The new Microcat EPC is built based on feedback from our global customers and delivers on three main objectives:

- Make parts selling faster and more accurate by evolving the core functionality of the EPC

- Increase the size of parts orders and streamline the sales process by empowering parts staff with handy add-on features

- Help Parts Departments implement self-serve eCommerce solutions for their wholesale customers by creating an EPC-powered platform

New EPC Vision for a New Era

As pioneers in the parts catalogue space for over 30 years, we’ve always seen the EPC as a mission critical tool for dealerships. Over the years, we have evolved and released new innovations in Microcat to keep up with technology and keep ahead of customer expectations.

Given the current economic conditions, this laser focus on innovation takes on a new importance for our customers. Our vision for our next-generation Microcat EPC is to help OEMs and their dealerships reduce cost and facilitate more OEM parts sales.

The factors driving the new Microcat EPC vision:

- New car sales are dropping, making Parts and Service a key focus

- Dealerships are facing greater competitive pressures especially from the Aftermarket suppliers. Speed and customer service are more important than ever before

- The need to leverage existing assets to make dealerships more efficient and cost-effective, with focus on greater Return on Investment (ROI)

- Collision and Mechanical customers expect dealerships to cater for online sales

- Bringing Parts and Service together to improve efficiencies and customer experience

As innovators, we believe the EPC is more than just a catalogue reference tool. It is central in facilitating better process control and sales automation, so parts staff can spend more time with customers and less time interpreting technical data.

A major opportunity for the new Microcat EPC is to facilitate faster and better communication between the Parts Department and their customers, both inside the dealership and with independent trade shops.

Evolving Core Microcat EPC Features – Faster, More Accurate and Better CSI

In developing the most advanced version of Microcat EPC yet, our teams used Customer-Centric Design (CCD) principles to make it more streamlined, automated and productive:

New Interface: The sleeker, more intuitive user experience streamlines catalogue navigation. Features and data elements are presented with depth and shadowing for a cleaner screen layout. Intelligent linking of catalogue sections means a more efficient workflow that saves time, improves sale process and drives better CSI.

Global Search: Want to look up VIN-precise parts with lightning speed and accuracy? We’re introducing ‘Global Search’, the fastest EPC search engine in the industry. You can search for vehicles and parts using the powerful and precise ‘one-step’ search box, without selecting a search type. Selling parts has never been faster.

Active Jobs: Need to serve multiple customers at a time? The new ‘Active Jobs’ automatically saves each look-up, so you can jump in and out of jobs, quickly and easily. Improve efficiency and parts sales effectiveness by better managing multiple customers and jobs at the same time.

Mobile EPC: Want the flexibility to access the EPC on any device? Redefine the parts selling process by selling genuine OEM parts on the go! The new, mobile-friendly and responsive design adds convenience and empowers your team and other dealership staff to access the OEM parts catalogue from any place, at any time.

Add-on Solutions to Streamline and Grow

As part of our broader Microcat EPC vision, we’re introducing industry-first solution add-ons to improve parts order size, drive better Parts Counter productivity and improve customer communications:

Service and Repair Menus

Often, many inexperienced Parts Interpreters might miss ‘related part’ sales opportunities. The new Microcat EPC introduces integrated VIN-precise menus, covering over 300 service, repair and accessory fitment jobs – so your staff have the knowledge to recommend and sell more parts and fluids. This level of parts visibility reduces unproductive discussions between the Parts Counter and the Technicians. Your Parts staff won’t have to call or walk over to the Service Department to find out which parts are required for a certain repair. A bonus if you’re practicing social distancing!

Messenger App

Can’t see your wholesale customers face-to-face? Need your Technicians in the workshop to remain in their bay? The new Microcat EPC has an integrated messaging app that connects the Parts Counter with other internal dealership staff and wholesale parts customers. The fast and efficient communication channel delivers accurate parts information, provides self-service parts ordering efficiencies for wholesale customers and grows CSI.

EPC Analytics

The best way to know if something is working is to measure it. The new Microcat EPC provides advanced EPC analytics to help OEMs understand the demand for parts by comparing demand to sales. Management can utilise these insights to better target marketing activities and grow parts sales performance.

Microcat Platform – EPC Powered Parts Selling Suite

Globally, our dealership customers have said that they can’t work and can’t sell parts without Microcat EPC – it’s seen as the engine of their Parts Department.

That has inspired us to create the Microcat platform – an integrated OEM parts selling suite of solutions – with Microcat EPC as the engine to power e-commerce capabilities for Collision and Mechanical part sales.

The powerful platform enables dealerships to extend parts selling beyond the Parts Counter by making the Parts Catalogue more accessible to wholesale customers, supporting OEM conquest programs and promoting self-serve tools that make it easy for customers to buy from the dealership.

Be Part of the Future with Microcat

With the steep decline in global new car sales, OEMs and dealerships can increase their revenue by boosting genuine OEM parts sales. Technology leadership is a key pillar to achieving this objective.

The new Microcat EPC is our biggest investment to date and it could very well be one of your best investments yet. It redefines the traditional EPC and reimagines the parts selling process.

It’s an EPC that positions your Parts Interpreters as knowledgeable and professional, providing the key tools to improve efficiency and maximise part sales opportunities.

In the next issue of Driving Force, we’ll look into how OEMs and their dealership network can recuperate their revenue loss of new car sales by expanding their Service business.

In the meantime, feel free to contact us to learn how you can innovate your parts sales processes and drive new efficiencies with the new Microcat EPC: start@infomedia.com.au.